Blog Nov. 26, 2019

Mobile Device Market Share and Mobile Data Speeds in Southeast Asia

In recent years, Southeast Asia’s mobile economy has been prospering rapidly. The e-Conomy SEA 2019 report* discusses a US$100 billion growth in 2019. The report also predicts the sector to hit US$300 billion by 2025. This boom in the region’s mobile economy may indicate an increase in the demand for mobile applications (apps). Across the globe, apps that require devices equipped with the latest functions and high-speed data networks are being developed. As such, developers aiming to launch these apps in Southeast Asia need to consider the devices commonly used in the region as well as the performance of local data networks. This article will investigate the mobile device market share and data networks in Southeast Asia, and introduce the data connection trends and considerations for releasing apps in the region.

*See: e-Conomy SEA 2019 report / Google

Mobile Device Market Share and App Compatibility in Southeast Asia

The most significant industry trend observed over the last four years demonstrates that over 100 million people became online users in the region’s six largest markets – Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam. Google reports that “90% of internet access in the region is via smartphone and the average user spends 3.6 hours each day accessing the internet on a mobile device” (See: Southeast Asia – State of Mobile Networks / Tutela). This has given rise to the mobile device market. Examining data usage at a customer and location-specific level shows that growth trends are consistent and unique in the region.

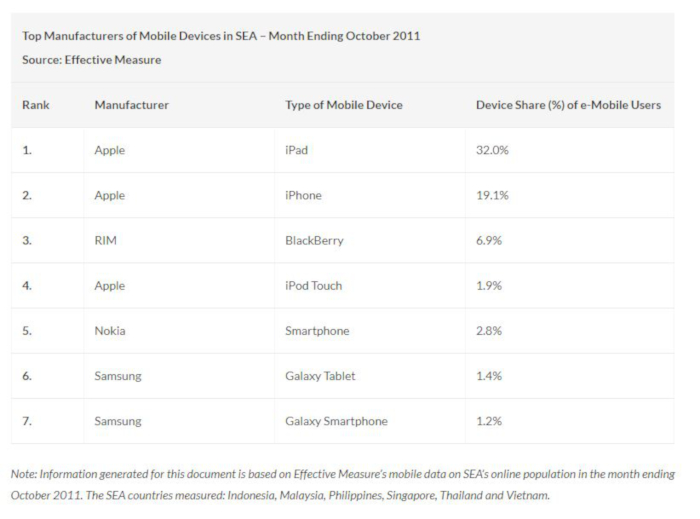

A report released in 2011 by Effective Measure, an online tool for measuring demographic data, found that Apple dominated in terms of market share in Southeast Asia. The report showed that 11.8 million internet users in Southeast Asia used Apple devices such as the iPad, iPhone, and iPod Touch. This accounted for the highest market share in Thailand and Singapore, with the iPad contributing 32% of the stock (See: Apple accounts to 53% of e-mobile device market share in Southeast Asia / Pinoy Tech Blog).

In 2019, the mobile market share changed a little in the region. Following the statistics of the DeviceAtlas 2019 report, Apple devices continue to reign supreme in Thailand, Singapore, Philippines, and Malaysia. Samsung, Oppo, and Xiaomi devices are leading in Indonesia (see: The most popular smartphones in 2019 / DeviceAtlas). In Vietnam, while Apple products have the largest percentage of mobile vendor market share (See: Mobile Vendor Market Share Viet Nam / Statcounter), Chinese smartphone brands have been gaining popularity.

Chinese brands such as Oppo, Vivo, and Xiaomi are rising in popularity on account of their intense marketing strategies, innovative handsets, and affordable prices. These three brands turned to Southeast Asia after taking two-thirds of the Indian and Chinese market share in terms of shipment (see: Chinese smartphone brands such as Oppo are winning in Southeast Asia despite concerns over Huawei / South China Morning Post). Relatedly, industry research agency Canalys reported that 62% of the handset shipments of the region, 30.7 million in total, have been taken over by these brands (See: Canalys: Chinese smartphone brands take 62% of Southeast Asia’s 30.7 million shipments / Canalys).

Local mobile handset manufacturers are securing their positions in Southeast Asia, as well. Domestic smartphone vendors have enjoyed success in the Philippines and Indonesia due to low prices, offers on entertainment, social media content, and apps. In contrast, some markets, such as Vietnam, remain challenging for local vendors because of the fierce competition from Chinese and global vendors. Regulations in some countries like Indonesia have benefited domestic vendors, as the government has mandated local production and increased the cost for global vendors (See: Smartphone Trends in Asia: The Rise of Domestic Brands in Southeast Asia%s Smartphone Markets / Marketwatch).

Specifications of mobile smartphones play a huge role in determining which apps a user can download and utilize. As such, what are the popular mobile devices in the region and how do they perform in terms of specifications and app compatibility?

Popular Mobile Devices In Southeast Asia

The Global Stats 2019 report showcases different market share tendencies within Southeast Asia (See: Mobile Vendor Market Share Worldwide / Statcounter). As mentioned, DeviceAtlas revealed that Apple’s iPhone is still very popular within Southeast Asia. This has been discovered by a real-time detection system to determine which smartphones are utilized the most in all the connected platforms – web, mobile networks, native apps. Accordingly, here is a list of the five most popular mobile devices that are being used by Southeast Asian countries in 2019:

The Most Popular Smartphones in Southeast Asia, 2019 (Source: DeviceAtlas)

| Country | Popular Smartphones |

| Indonesia | Samsung Galaxy J2 Prime, Oppo A3s, Oppo A37f, Xiaomi Redmi 5A, Xiaomi Redmi 4A |

| Malaysia | iPhone 7 Plus, iPhone 6, iPhone 7, Samsung Galaxy J2 Prime, iPhone X |

| Philippines | iPhone 6, iPhone 7 Plus, iPhone 6S Plus, iPhone 7, iPhone 6S |

| Singapore | iPhone 7, iPhone X, iPhone 7 Plus, iPhone 8, iPhone XR |

| Thailand | iPhone 7 Plus, iPhone 7, iPhone 8, iPhone X, iPhone 6S |

Specifications of Major Mobile Devices

In the Philippines, Apple’s iPhone 6 is the leading model. Released in 2014, the iPhone 6 was cherished for its improved design, specifications, camera offerings, and battery life (See: iPhone 6 Review / TechRadar). iPhone 7 Plus and iPhone 7 are also quite popular, with the former being regarded as the first iPhone to come with a rear dual-camera setup (See: iPhone 7 Review / The Verge).

Released in 2017, iPhone X is very popular in Singapore. The phone is powered by Hexa-core (2.9 GHz, Dual-core, Monson +1.42 GHz, Quad-core, Mistral) processor. It runs on the Apple A11 Bionic Chipset and has 3GB RAM internal storage. This phone has a bezel-less design, so the screen is wider than the iPhone 8 Plus (5.5 display size), but the overall size of the phone is smaller (See: Apple iPhone X Camera Review / CameraJabber).

Samsung’s Galaxy J2 Prime breaks Apple’s rank in Indonesia with its long-lasting battery power, 5.0” display size, 1.5 GB RAM, 1.4GHZ Quad-Core processor, 2600 mAh battery, 8 GB internal storage (See: Galaxy J2 Prime LTE / GSMArena). Followed by Oppo A3s, which comes with a 6.20-inch display, 1.8GHz octa-core Snapdragon 450 processor, 2GB RAM 16GB inbuilt storage, 4230 mAh battery capacity (See: Oppo A3s / Gadgets360).

Due to the competitive marketing tactics of the emerging Chinese smartphone players, the overall picture is changing. This is also a major driving force for brands to come out with new models each year and improve features. Furthermore, the popular models of mobile phones in each Southeast Asian country may provide insight into their priorities in selecting devices to browse the internet. While iPhone users may enjoy seamless internet browsing with Apple’s strong processors, others may prefer Samsung and Oppo products for their lasting battery life.

Applicability

In industrialized markets such as North America, Europe, and East Asia, regular online shoppers are less interested in spending time on the internet. In these markets, apps tend to focus on particular services, streamlining the user experience, reducing the time it takes to choose products, and simplifying the submission of orders for users. In Southeast Asia, the opposite is occurring. Companies are creating more engaging user experiences for the simple reason that higher engagement is perceived as an antecedent to the business’s progress (See: e-Conomy SEA 2019 report / Google).

GfK’s Life Study indicates that consumer trends towards goods are shifting. If a larger memory or screen size and multiple high-megapixel cameras can improve the whole user experience, the innovations will probably encourage the consumers’ demands (See: Global smartphone sales grew five percent to hit $522 billion in 2018 / GfK).

In assessing the compatibility of the region’s top mobile devices to popular apps, the iPhone 6 can serve as a representative for Apple smartphones since it is the oldest model. As such, the iPhone 6 supports the iOS 12 software but is not compatible with iOS 13. Additionally, the Samsung J2 Prime, which runs on Android 6.0 (Marshmallow), can be a basis for assessing Android smartphones. The following tables indicate the most downloaded free apps in the United States and their compatibility requirements:

Top iPhone Apps in the United States (as of Nov. 19, 2019)(Source: APPlyzer)

| Title | Category | Compatibility |

| Disney+ | Entertainment | Requires iOS 11.0 or later. Compatible with iPhone, iPad, and iPod touch. Apple TV. |

| Ink Inc. – Tattoo Tycoon | Games | Requires iOS 9.0 or later. Compatible with iPhone, iPad, and iPod touch. |

| Brain Out | Games | Requires iOS 10.3 or later. Compatible with iPhone 5S, iPhone 6, iPhone 6 Plus, iPhone 6S, iPhone 6S Plus, iPhone SE, iPhone 7, iPhone 7 Plus, iPhone 8, iPhone 8 Plus, iPhone X, iPhone XS, iPhone XS Max, iPhone XR, iPhone 11, iPhone 11 Pro, and iPhone 11 Pro Max. |

| TikTok – Make Your Day | Entertainment | Requires iOS 9.3 or later. Compatible with iPhone, iPad and iPod touch. |

| Minecraft Earth | Games | Requires iOS 12.0 or later. Compatible with iPhone 6S, iPhone 6S Plus, iPhone SE, iPhone 7, iPhone 7 Plus, iPhone 8, iPhone 8 Plus, iPhone X, iPhone XS, iPhone XS Max, iPhone XR, iPhone 11, iPhone 11 Pro, and iPhone 11 Pro Max. |

| Walkie-talkie – COMMUNICATION | Social Networking | Requires iOS 9.0 or later. Compatible with iPhone, iPad, and iPod touch. |

| Call of Duty®: Mobile | Games | Requires iOS 9.0 or later. Compatible with iPhone 5S, iPhone 6, iPhone 6 Plus, iPhone 6S, iPhone 6s Plus, iPhone SE, iPhone 7, iPhone 7 Plus, iPhone 8, iPhone 8 Plus, iPhone X, iPhone XS, iPhone XS Max, iPhone XR, iPhone 11, iPhone 11 Pro, and iPhone 11 Pro Max. |

| Brain Puzzle: IQ Challenge | Games | Requires iOS 9.0 or later. Compatible with iPhone, iPad, and iPod touch. |

| YouTube: Watch, Listen, Stream | Photo & Video | Requires iOS 11.0 or later. Compatible with iPhone, iPad, and iPod touch. Apple TV. |

| Pokey Ball | Games | Requires iOS 9.0 or later. Compatible with iPhone, iPad, and iPod touch. |

Top Android Apps in the United States (as of Nov. 19, 2019)(Source: APPlyzer)

| Title | Category | Compatibility |

| Disney+ | Entertainment | Requires Android 5.0 and up |

| Samsung Notes | Productivity | Varies with device |

| Ink Inc. – Tattoo Tycoon | Games | Requires Android 7.0 and up |

| Messenger – Text and VideoChat for Free | Communication | Varies with device |

| Kolor It! | Games | Requires Android 4.2 and up |

| Call of Duty®: Mobile | Games | Requires Android 4.3 and up |

| Draw Race | Games | Requires Android 4.4 and up |

| Clash of Blocks | Games | Requires Android 5.1 and up |

| Icing On The Cake | Games | Requires Android 4.4 and up |

| Crazy Climber! | Games | Requires Android 4.1 and up |

Based on the tables above, most of the top apps in the Apple App Store and Google Play Store are compatible with iPhone 6 and Samsung J2 Prime, respectively. Therefore, the devices that currently hold the top market share in Southeast Asia are compatible with many popular apps. However, apps that require higher system requirements may be unable to support these devices. As such, it is important for developers to consider the specifications of major devices used in the region before launching an app.

Mobile Internet Connection Speed in Southeast Asia

Mobile connectivity has improved in the region during the past years. Today, access has even improved outside big cities. Prices have fallen considerably as mobile speed caught up. The establishment of mobile virtual network operators (MVNOs) has played a vital role in changing the landscape, thus stirring competition (See: e-Conomy SEA 2019 report / Google).

Mobile Data Speeds in Southeast Asia

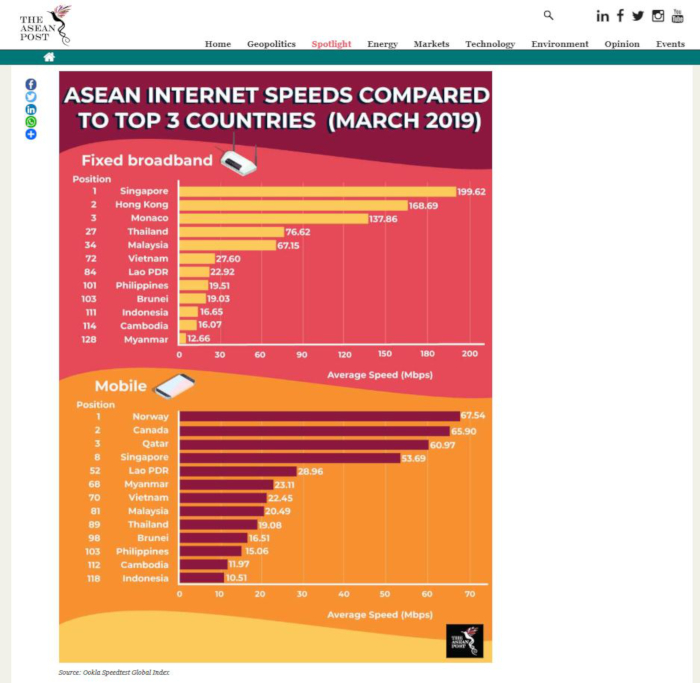

Ookla’s Speedtest Global Index, a widely used indicator to measure internet speeds across the globe, indicated in March 2019 that the fastest fixed broadband speed of 199.62 megabits per second (Mbps) was in Singapore. Within the region, Thailand (76.72 Mbps, 27 in the world) and Malaysia (67.15 Mbps, 34 in the world) finished second and third in the fixed broadband category (See: Are ASEAN’s internet speeds world class? / The ASEAN Post).

In the mobile internet category, Singapore is leading in the region with 53.69 Mbps, followed by Lao PDR 28.96 and Myanmar 23.11 (See: Singapore wins Internet speed race / The ASEAN Post).

According to Anthony Ho, Equinix Director of Regional Product Management, “Interconnection Bandwidth in Asia-Pacific is expected to grow 46% per annum, approaching nearly a quarter (22%) of global traffic.” (See: How will 5G impact industries in Southeast Asia? / CIO)

There have been a few announcements from ASEAN countries regarding an imminent deployment of 5G technology, as mentioned. Companies and startups are set to make the most of the prospects brought about by 5G to generate growth and support digital transformation initiatives (See: How will 5G impact industries in Southeast Asia? / CIO).

Most of the smartphone giants present within the region have released 5G-capable handsets (Samsung, Huawei, Xiaomi, Oppo), showcasing incredible speeds. There is a notable exception for Apple; iPhone 11 does not support the next-gen mobile service, as Apple believes 5G needs more time to be ready (See: Apple’s iPhone 11 doesn’t have 5G because 5G isn’t ready for the iPhone / The Verge). However, one of the first countries in Southeast Asia – The Philippines – is about to roll-out 5G via a partnership with local telecom Globe and Chinese tech giant Huawei, though the deployment is in its earliest stages (See: Why 5G May Shape the Future for Founders in Asia Pacific / Entrepreneur). Singapore, as the leading country, plans to operate two full-fledged 5G networks and two smaller ones with limited coverage by next year (See: 5G networks planned for Singapore: What you need to know / The Straits Times).

Possibility of Cloud Applications

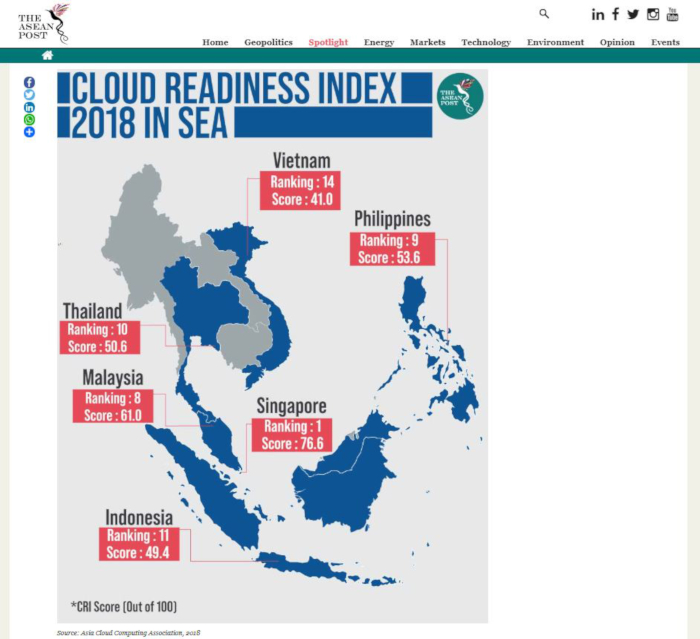

The cloud computing market is also growing in terms of services offered and the number of industry competitors entering the market. Cloud computing is primarily for sharing a network of servers that provide centralized data to remote devices through the internet. It is referred to as a common storage platform with which multiple devices in the network can access data at once (See: cloud computing / Webopedia). Cloud technology is popular with small-to-medium sized enterprises as it is more profitable than installing local servers and at the same time, it allows regional companies to connect and compete on a global scale (See: Singapore leads in cloud tech / The ASEAN Post).

As for now, Southeast Asia’s cloud computing market is composed of big companies including Amazon, Akamai Technologies, CA Technologies, Alibaba, Google Inc. According to Adroit Market Research Report, the regional cloud computing market revenue is estimated to reach US$40.32 billion by 2025 (See: Singapore leads in cloud tech / The ASEAN Post).

Mobile Data Connection Trends and Key Points in Southeast Asia

The digital transformation of Southeast Asia creates opportunities for small and medium-sized enterprises (SMEs). The ongoing growth of smartphones and mobile internet penetration is feeding the rise of the “app economy.” Understanding the app economy is essential because of its growing economic significance (See: The Mobile Economy Asia Pacific 2015 / GSMA).

Since app and other digital content can be produced, distributed and consumed virtually anywhere there is a network connection, it opens up new economic opportunities and business models. As the region takes the lead in global internet growth, its digital citizens rely more and more on the convenience and accessibility of mobile apps in their daily life (See: Exploring the emerging mobile app market trends in Southeast Asia / Tech Collective).

Currently, Southeast Asia’s internet economy is exceeding US$100 billion and according to estimations, it will triple by 2025 (See: Southeast Asia’s internet economy booming / The ASEAN Post). By some metrics, its mobile economy far surpasses that of more developed Western nations – phablets (large-screen mobile devices) command 73% of Southeast Asia’s mobile device market, compared to just 48% in the US (See: Exploring the emerging mobile app market trends in Southeast Asia / Tech Collective).

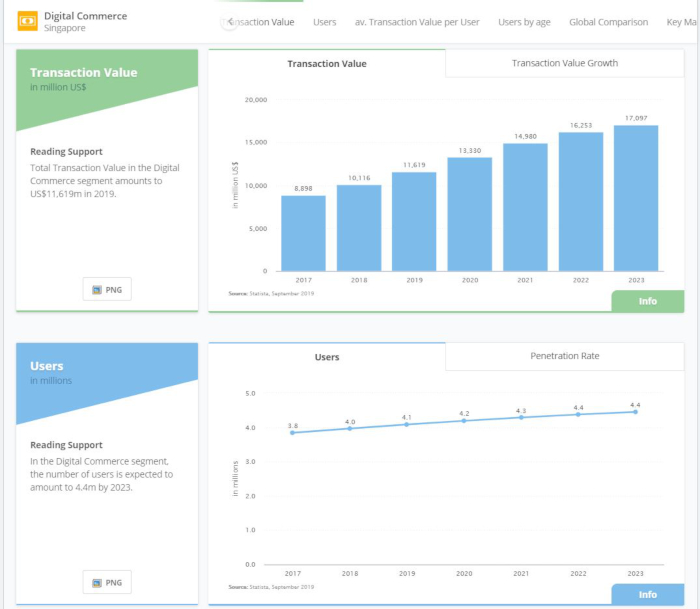

Singapore

Singapore is ranked at the top among app-based economies in Asia. And with proactive government policies that aggressively roll out fiber networks and support shaping the future of 5G, Singapore has much potential in the mobile app business. Singapore even has high scores in social and private metrics such as mobile payment readiness, credit card penetration rate, and internet usage. However, it is important to note that Singapore ranks 6th in cybersecurity, which is an area that needs improvement to maintain its spot among the highest mobile app economies (See: Singapore tops mobile app economy, but for how long? / e27).

Indonesia

Indonesia has the 4th largest world population and is one of the most mobile-first countries in the world. Among its 150 million internet users, 95% are mobile and 60% of all adult Indonesians have smartphones. Indonesians reportedly spend 206 minutes on social media daily, compared to the global average of 124 minutes. Indonesia also has the highest rate of mobile e-commerce among other countries, with 76% of all Indonesian internet users making purchases from their phones (See: Indonesia: The New Tiger Of Southeast Asia / Forbes).

Philippines

There are more than 69 million internet users in the Philippines. Three-quarters of this figure are online shoppers between ages 16 and 64, according to a Global Web Index report. The country has the smallest internet economy of the six primary markets in Southeast Asia, despite being home to the region’s second-largest population (See: DIGITAL 2019 SPOTLIGHT: ECOMMERCE IN THE PHILIPPINES / Datareportal).

In 2018, online consumer goods purchases totaled just US$840 on online purchases. Electronics and physical media accounted for the greatest share of the total. In addition, the annual growth in retail ecommerce sales is predicted to grow 31% (See: DIGITAL 2019 SPOTLIGHT: ECOMMERCE IN THE PHILIPPINES / Datareportal).

Southeast Asia: Land of Great Promise

Just over a decade ago, approximately four in five Southeast Asians had no internet connectivity. Amid rapid changes enabling internet access in the region, Southeast Asians have become the most engaged mobile internet users in the world. Accordingly, Southeast Asia’s online industry is expected to grow by 200% over the next five years according to Google, Bain & Company’s 2019 report (See: e-Conomy SEA 2019 report / Google).

The growth is powered by fundamental changes in consumer behavior, fast-growing disposable income, and rapid growth in smartphone ownership. The region offers a great opportunity for app and game developers to expand their user base and business.

Southeast Asian countries share many cultural and economic characteristics, from a plethora of diverse languages to having unique consumer preferences. Companies from outside the region may find it challenging to penetrate Southeast Asian markets. On such occasions, it is advisable to seek the help of multilingual experts like adish. Upon launching in 2010, we at adish Co., Ltd. have provided monitoring, community management, customer support, and other multilingual online services to help the world as best as we can. To learn more about multilingual support, contact us at adish Co., Ltd. today.